Compound interest in crypto: APR vs APY (and how it impacts your returns)

Reading time: 7–10 min • Category: Interest / DeFi

Simple vs compound interest, the difference between APR and APY, and where this can either help you or hurt you in savings, staking and DeFi.

Understanding compound interest is half the battle if you don’t want to be fooled by “nice looking” numbers in DeFi, savings or staking. The difference between APR and APY is not a minor technical detail — it directly affects what you actually earn (or lose) over time.

⏱️ Compound interest + APR vs APY in 60 seconds

- APR (Annual Percentage Rate) is simple interest: the yearly rate shown, without interest on top of interest.

- APY (Annual Percentage Yield) already includes the effect of compound interest — earning interest on top of previous interest.

- With the same “20% per year”, a product with APY can give you more than one with APR, depending on how often interest is compounded (yearly, monthly, daily…).

- In crypto, there’s a twist: APY is often paid in tokens, not euros/dollars — if the token dumps, your fiat value can go down even with a high APY.

1️⃣ First, the basics: simple vs compound interest

🔹 Simple interest

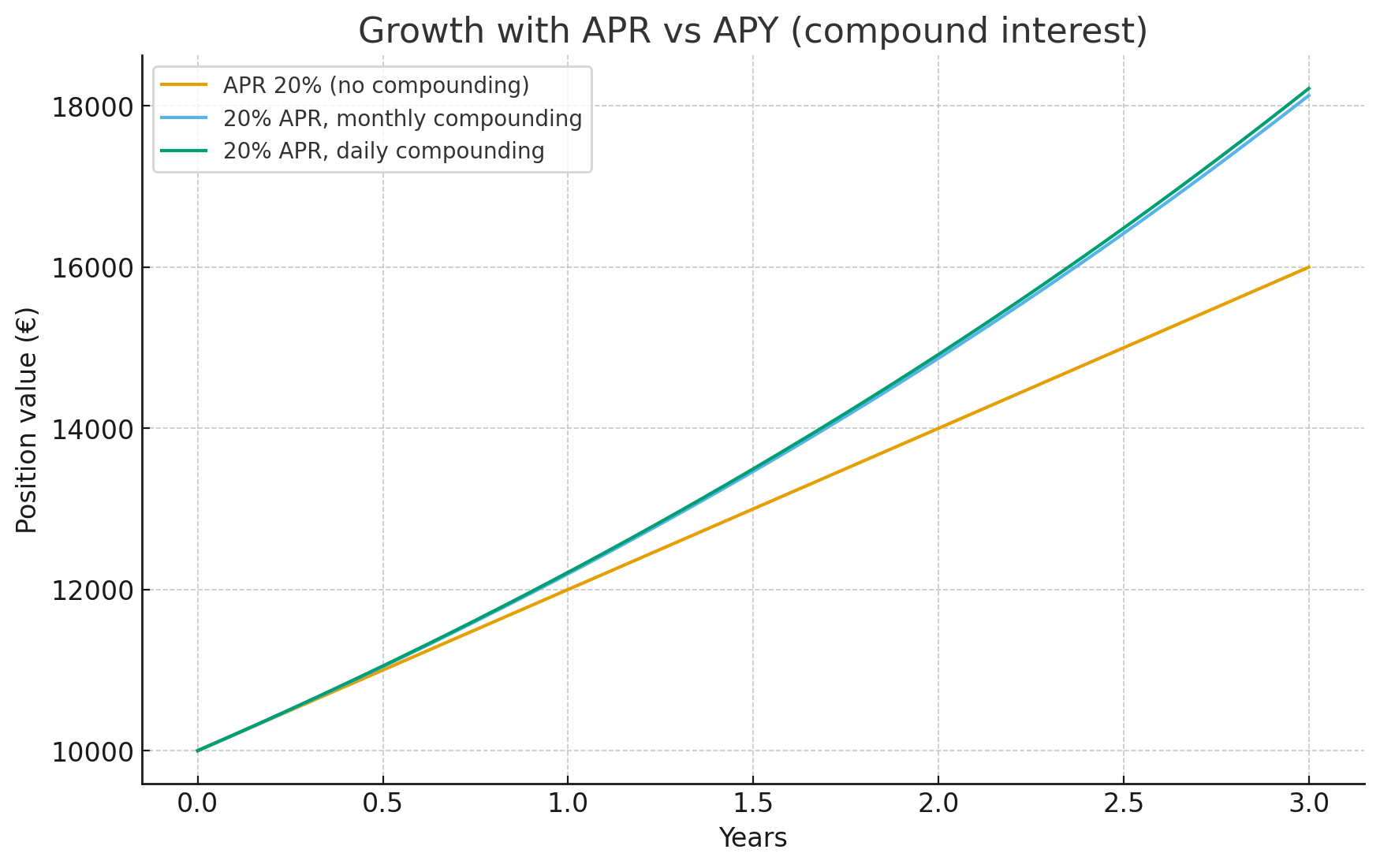

Imagine you put 10,000 € into a product that pays 20% APR, with no compounding.

- Year 1: 10,000 € + 2,000 € = 12,000 €

- Year 2: 10,000 € + 4,000 € = 14,000 €

- Year 3: 10,000 € + 6,000 € = 16,000 €

The formula is always:

interest = initial capital × APR × number of years

Interest is always calculated on the same 10,000 €. No snowball effect.

🔸 Compound interest

Now take the same example but with 20% APR, compounded monthly:

- You still see “20% APR”, but the interest you earn every month is added to your capital.

- After 1 year, instead of 12,000 €, you end up with around 12,429 €.

- If compounding is daily, that rises to roughly 12,452 €.

After 3 years, the gap is bigger:

- APR 20% with no compounding (simple interest): ~16,000 €

- 20% APR with daily compounding (higher APY): ~19,309 €

This is where compound interest starts to kick in: each period, interest is calculated on a larger base.

2️⃣ So what exactly is APR? 💳

APR (Annual Percentage Rate) is the yearly interest rate without the effect of compounding built in.

You’ll see APR a lot in:

- Loans (credit cards, personal loans, margin, etc.).

- Simpler savings / lending products.

- Crypto lending products that just show a flat yearly rate.

Key points:

- It’s a static metric: 10% APR is 10%/year on the reference capital.

- It’s easy to compare, but doesn’t tell you everything if compounding is happening in the background.

- Whenever you only see APR, ask yourself:

“Is this really simple interest, or is there auto-reinvest that should be shown as APY?”

3️⃣ And what is APY? 📈

APY (Annual Percentage Yield) includes the effect of compound interest.

In simplified form:

APY = (1 + APR / n)n − 1

Where n is the number of compounding periods per year (monthly = 12, daily ≈ 365, etc.).

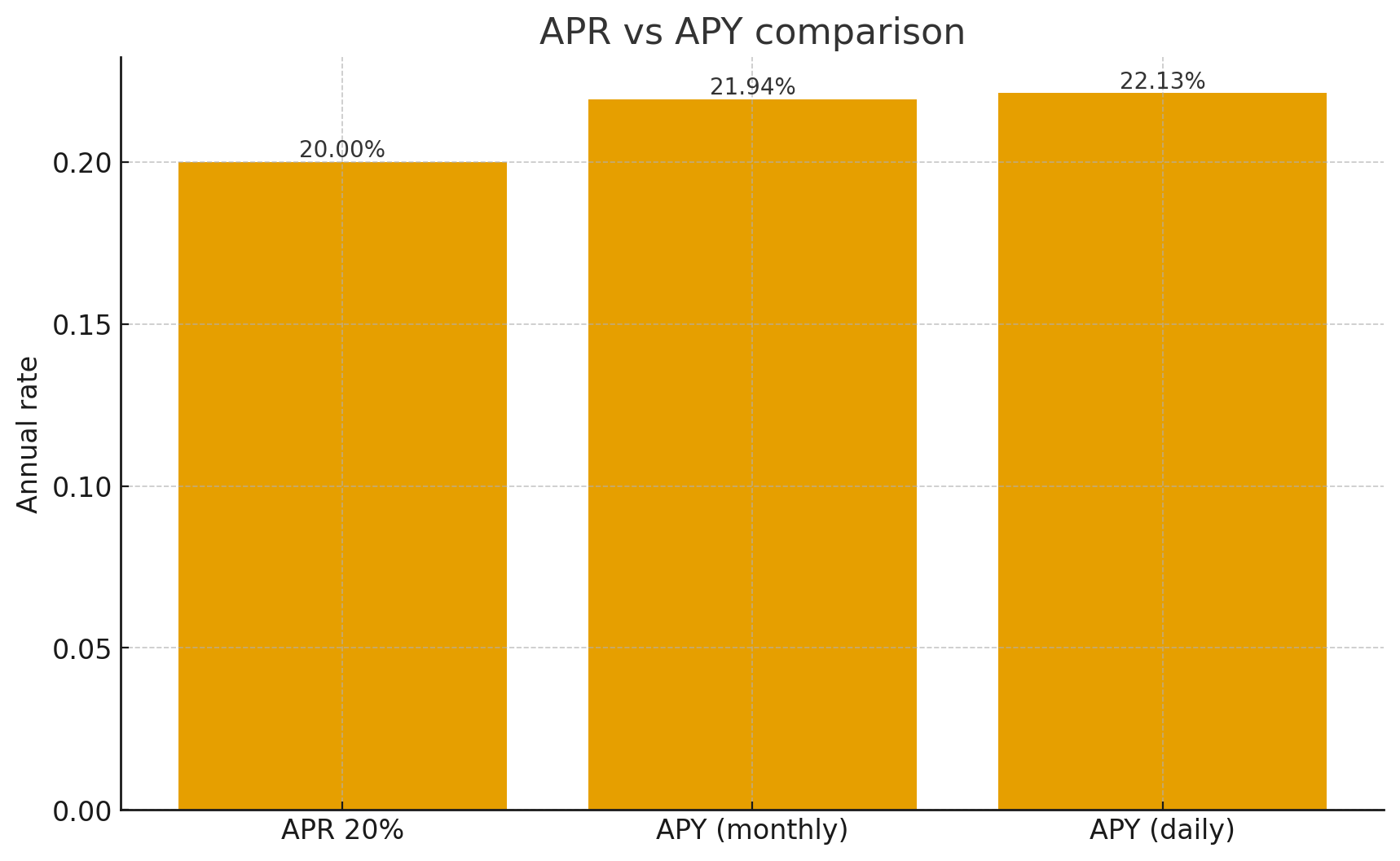

Example with 20% APR:

- Monthly compounding: APY ≈ 21.94%

- Daily compounding: APY ≈ 22.13%

In other words:

- APR is the “base” rate.

- APY shows what you effectively earn over a year, with interest on interest, assuming reinvestment.

4️⃣ Where this hits you in crypto (Earn, DeFi, staking) 🪙

In crypto, APR and APY show up pretty much everywhere:

- Savings / Earn products (flexible or locked).

- Staking (on exchanges or on-chain).

- Yield farming / liquidity mining.

- DeFi protocols paying rewards in tokens.

🧩 1. APR with manual compounding

- The platform shows an APR, but you receive rewards periodically (daily, weekly, etc.).

- If you don’t reinvest, your behaviour is close to simple interest.

- If you do reinvest consistently, you effectively create your own personal APY.

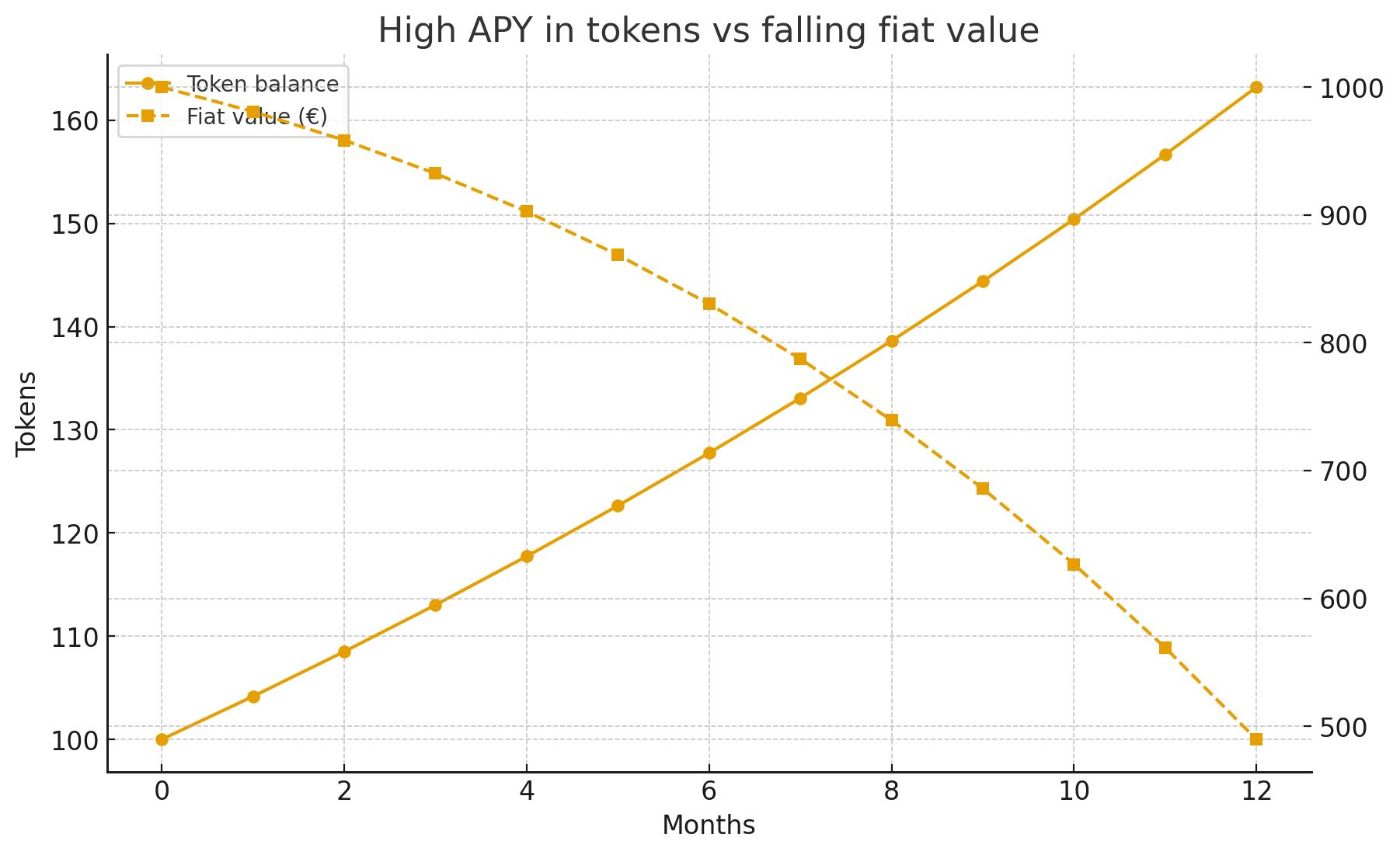

🧨 2. “Absurdly” high APY

- Very high APYs can come from:

- Very frequent compounding.

- Aggressive token emissions as rewards.

- If the token drops 60%, a huge APY in token terms can still leave your euro balance worse than doing nothing.

🎭 3. APY in tokens ≠ guaranteed fiat return

- Many platforms show APY in number of tokens, not in fiat.

- Example: 100% APY in XYZ might mean “your XYZ balance doubles in one year”, but:

- If XYZ dumps 70%, your euro value may end up below where you started.

- The takeaway:

Always look at rate + asset + risk — not just the big shiny number.

5️⃣ How to compare products in practice 🧮

When you’re faced with multiple products and different rates, the play is to normalise and compare what actually matters.

- Try to bring everything to APY, if you know the compounding frequency.

- Compare products with:

- The same asset (USDT vs USDT, BTC vs BTC, etc.).

- Similar duration (same term / lock-up).

- Comparable risk profiles (custody, protocol, smart contracts, exchange, etc.).

- Check whether APY is shown in:

- Fiat terms (simulated in euros/dollars), or

- Number of tokens (very common in crypto).

🧾 Quick mental checklist

- Am I looking at APR or APY?

- If it’s APR, can I estimate what APY would be with the real compounding schedule (monthly, daily, etc.)?

- If it’s APY in tokens:

- What happens if the token price drops 30–50%?

- Does that level of risk make sense for me?

6️⃣ How to apply this in real life

At this stage you don’t need to memorise formulas — you need to read the label and understand the context.

- Don’t mix up APR and APY: always ask which metric you’re seeing.

- When analysing savings / staking or DeFi:

- Compare products using the effective rate (APY), not just the loudest number on screen.

- Don’t choose based on rate alone: consider risk, liquidity and the currency you’re actually being paid in (token vs fiat).

7️⃣ TL;DR — what I want you to remember 🧵

- APR = “dry” yearly rate, simple interest.

- APY = yearly rate that already includes compound interest, assuming reinvestment.

- For the same APR, APY goes up as compounding becomes more frequent.

- In crypto, many APYs are based on tokens, which tells you nothing about your final result in euros.

- Before jumping into a yield product:

- make sure you know whether it’s APR or APY,

- ask what the compounding frequency is,

- and remember that a falling token can destroy any APY that looks pretty on screen.

More on cryptoslug.pt — Gunbot strategies, automation & discipline.