1. The snapshot: seeing the account as a map, not random numbers

This Binance account does not live in isolation: it is one of the core blocks of the CryptoSlug Operations Center page — the cockpit where I track exposure, active bots and infrastructure. This is the live account connected to my current Gunbot setup (DeFi licence), where the strategies in production run on the pairs and percentages you see in this article.

Whenever I make relevant changes to the account structure or to the bot stack, the Operations Center is updated first — and the War Log records the “why” behind those changes. The goal is to keep aligned what is on screen (dashboard) and what is written down (plan).

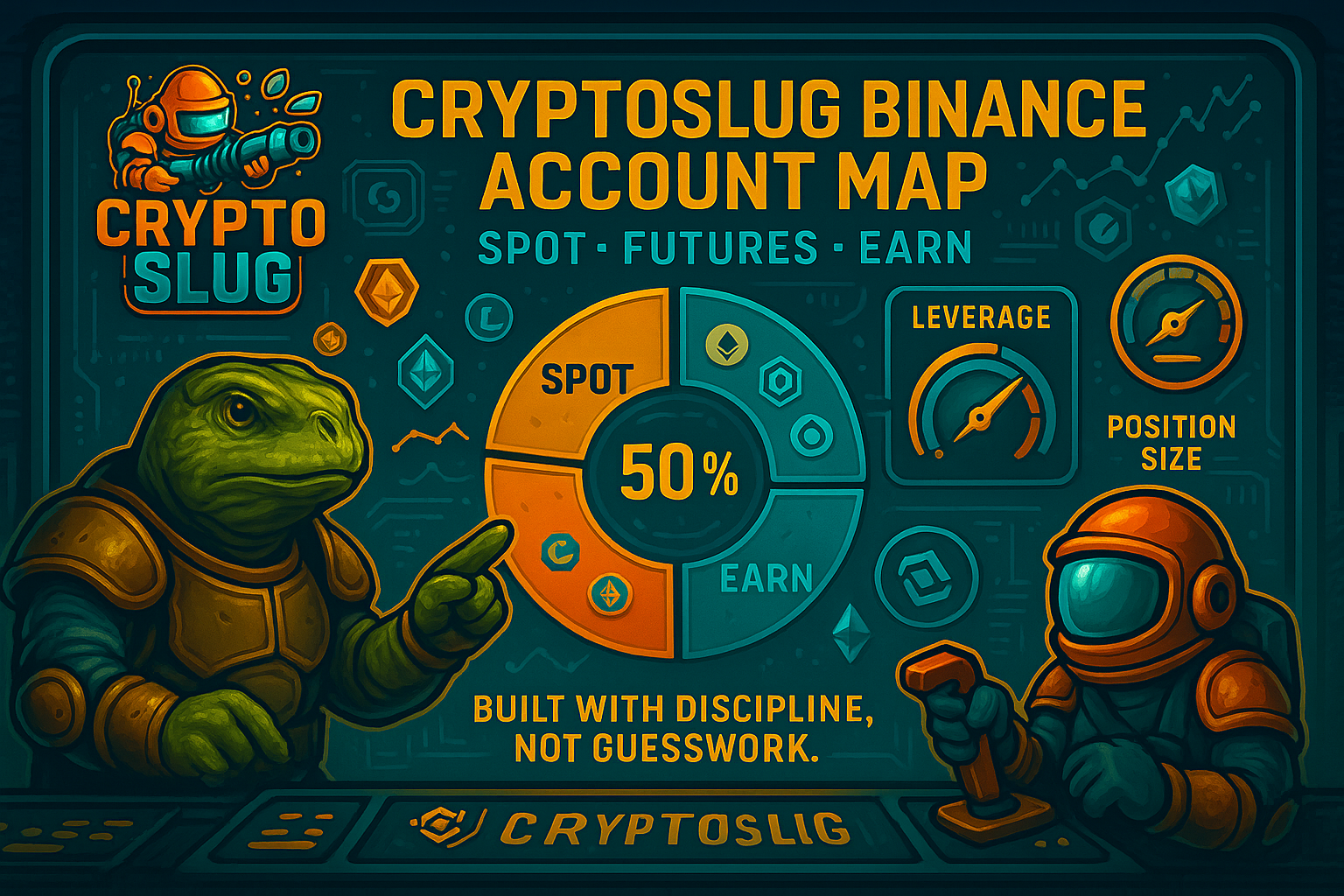

At the top of the “Binance Account & Exposure” section in the Operations Center, there’s a simple summary of the current structure of the CryptoSlug account:

- A ring (donut style) that shows the distribution between 🟢 Spot, 🟠 Futures and 🟣 Earn.

- A line with approximate values, for example: Spot: 54%, Futures: 10%, Earn: 37%.

The goal is not to hit the exact cent; it’s to have a clear idea of who really drives the account. If Spot dominates, the account is oriented towards direct asset ownership. If the Futures slice grows too much, the account starts to behave like a disguised leverage bomb.

In the CryptoSlug Binance account, the message is obvious:

- Spot acts as the base layer.

- Earn works as an airbag and reinforcement.

- Futures is a tactical tool, not the center of the universe.

2. Spot in production: the skeleton of the account

Spot is split into two main fronts to avoid everything becoming a chaotic ticker list: Core and Alts.

2.1 Core — the backbone

The “Core” category groups the coins that have a structural role in the setup, such as:

- SOL – Core · high liquidity

- LINK – Core · oracles

- ADA – L1 · structural exposure

- DOGE – High-volatility meme · used as a controlled laboratory to test exposure to extreme cycles without compromising the core

The criteria here are not “coin of the week”, but rather:

- Good liquidity.

- Clear narrative.

- A defined role in the portfolio.

Core Spot is treated as strategic capital: it’s not meant to be flipped every time there’s a 15% pump on some meme. It’s the layer that keeps the account anchored even when the market shakes.

2.2 Alts — the controlled lab

In the “Alts” section you find more experimental coins with a clear tactical function, such as:

- SOMI – Altcoin · spot in production

- XRP – Liquid · remittances profile

- Other alts with a well-defined percentage of overall Spot.

The philosophy here is very different from the Core layer:

- Positions are limited by percentage of Spot, not by impulse.

- Each alt comes in with a specific mission (volatility, narrative, hedge, test, etc.).

- No position enters “just because”; it always comes with label and context.

Taken together, Spot sends the following message:

🎯 Message from the CryptoSlug account: “Spot is the main body. Core brings stability; Alts bring testing and growth — always with limits and labels.”

3. Futures in production: tool, not addiction

In the central column of the account you find the Futures in production, with pairs such as:

- BNBUSDC Perp – direction LONG

- LINKUSDC Perp – direction LONG

- XRPUSDC Perp – direction LONG

In the summary of this layer, the tech sheet is clear:

- Mode: USDⓂ Futures · Multi-Assets

- Average leverage: 5x · max: 8x

- Note: 🟠 Leveraged · requires discipline · Risk: moderate

In trench language:

- Futures are not a casino; they’re a surgical tool.

- The Futures slice lives in a controlled portion of the account (for example ~10%).

- Leverage has explicit limits, instead of the classic “let’s see how far this goes”.

🧊 Difference from the usual “straight line to liquidation” pattern: the account knows how many % are leveraged, in which pairs, and with what ceiling. It’s not a graveyard of random open positions.

4. Earn as airbag: Flexible, Locked and Staking

The third column is the Earn Composition, divided into three blocks: Flexible, Locked and Staking. This is where the account tries to turn inertia into yield without completely dropping its guard.

4.1 Flexible — liquidity with interest

Flexible includes assets that already make sense to hold mid/long term and now earn a bit more, for example:

- BTC – BTC · core in Earn — a meaningful chunk of Earn.

- BNB – BNB · yield + discounts.

- DOGE – DOGE · vol & meme – a small, clearly labelled position.

- ETH – ETH · base in Earn.

- LINK – LINK · oracles in Earn.

The logic is simple:

- Put into Flex what already made sense to hold anyway.

- Avoid hunting absurd APYs in tokens that don’t fit the base strategy.

- Keep liquidity relatively accessible without venturing into opaque products.

4.2 Locked — conscious commitment

In “Locked” products, the account accepts locking part of certain assets for a period in exchange for higher APY. The rule is basic but crucial:

- Only lock a fraction of what you have in that asset.

- Never lock emergency funds or money you might need.

- Confirm if there’s extra exposure (for example, DeFi under the hood).

Locked, used this way, works as tactical reinforcement, not as a prison for the entire balance.

4.3 Staking — tactical reinforcement

In the Staking section, you’ll see assets like WBETH in “liquid staking” mode, where you earn extra yield while keeping some flexibility. Again, the rule is clear:

- Staking is used to reinforce positions that are already structural, not to invent exotic strategies.

- Percentages are controlled: Earn exists as an airbag + discreet amplifier, not as the core of the risk.

🟣 In short: Earn is treated as an airbag and amplifier for the base strategy — not as random fishing in anything that pays yield.

5. What this account is NOT (and doesn’t want to be)

From the way the map is drawn, the CryptoSlug Binance account makes three things very clear about what it doesn’t want to be:

- ❌ It’s not a Futures casino with Spot as an afterthought.

- ❌ It’s not a shitcoin graveyard built on FOMO entries.

- ❌ It’s not a backpack full of opaque Earn products chased only for APY.

Instead:

- It uses Spot as the base.

- It uses Earn as an inertia brake and reinforcement.

- It uses Futures as a precision tool, with well-defined limits.

6. How to apply this example to your own account

The goal of this War Log entry is not for you to copy the exact pairs or percentages. It’s to copy the way of thinking about your own Binance account.

6.1 Draw your snapshot

- Know what percentage you have in Spot, Futures and Earn.

- If you can’t answer that, you have a map problem before you have a “strategy” problem.

6.2 Define your base Spot

- Which coins are your Core?

- Which are your experimental Alts?

- What is the maximum percentage you accept for each group?

6.3 Put brakes on Futures

- Decide on a maximum Futures exposure (% of the account).

- Define a maximum acceptable leverage.

- Write this down. If you can’t write it, you’re not managing risk — you’re gambling.

6.4 Organise Earn

- Separate mentally (or in a sheet) Flexible / Locked / Staking.

- Make sure you’re not locking money you might need.

- Confirm you understand the mechanics of each product you use.

6.5 Review the map, not just PnL

- Don’t look only at “how much did I win/lose”.

- Look at the shape of the account: distribution, balance, risk.

7. Conclusion: having a Binance account is not the same as having a strategy

The CryptoSlug Binance account is a lab in production: it’s not perfect, but it’s intentional. Spot, Futures and Earn are not just three random boxes — they form a map where each layer has a function, limits and a label.

☑️ If there’s one thing to take from this War Log: having a Binance account is not the same as having a strategy. Strategy begins when you can say, out loud and in writing, where your risk is and what each piece of your account is supposed to do.

More on cryptoslug.pt — Gunbot strategies, automation and discipline.