1. Why risk management comes before “making money” ⚠️

Before you think about APR, APY, DCA, bots or “pro” strategies, there’s a basic question:

How much can you lose without blowing up your plan?

Risk management here is not an Excel formula. It’s deciding up front:

- How much money can go into crypto 🧱

- How much you can see drop without panicking 📉

- How long you can stay exposed ⏱️

Without this, any strategy — even a good one — can fail because you can’t handle the path.

2. What “risk” means for a hodler (not just volatility) 🎢

When you look at a chart, you see candles going up and down. But for you, as a person, risk is something else:

- Liquidity risk: using money you’ll need for bills/rent in the next few months.

- Behaviour risk: selling at the worst moment because you can’t stomach the drop.

- Concentration risk: being too loaded into 1 or 2 assets.

- Product risk: entering stuff you don’t understand (DeFi, loans, complex products).

To simplify, let’s think of risk in 3 dimensions:

- Amount – how much you have in there 💰

- Drawdown – how much you can see drop without breaking 💥

- Time – how long you can wait without needing that money ⏳

Everything else (APY, strategies, etc.) spins around this.

3. Position size: how much money can go in? 💸

First, the obvious thing most people ignore:

Money you’ll need in the next 6–12 months does not go into crypto. Period.

For a hodler in the basic phase, you can think like this:

- Define a fixed monthly amount that feels comfortably safe.

Example: “I can put 50 €/month without breaking anything in my life.” - Define a maximum cap for crypto exposure, like:

“In total I want to stay between 5% and 10% of my net worth.”

If you catch yourself thinking:

- “If this goes wrong I don’t know how I’ll pay X…”

→ your position size is wrong.

- Does this money pay rent/food/bills? → Then it doesn’t go in.

- If this drops 50%, will I need to touch it? → if yes, you’re risking too much.

- If you couldn’t add more money to crypto for 1 year, could you live with that?

4. Drawdowns and recovery time: the boring maths no one wants to see 📉➡️📈

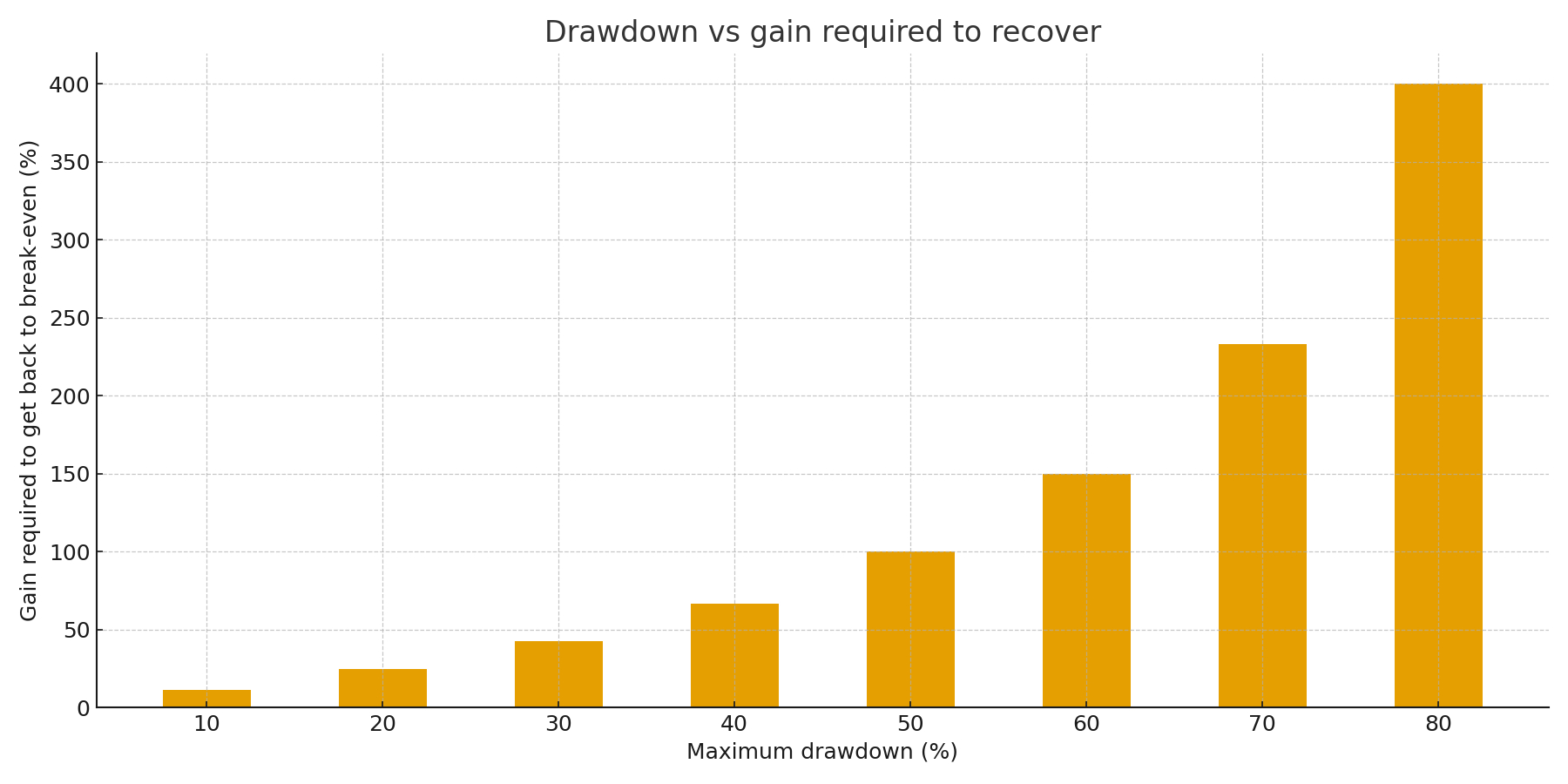

Here comes the first chart:

Chart 1 — Drawdown vs required recovery

risk-drawdown-recovery-en.png

Idea:

- X axis: maximum drawdowns (−10%, −20%, −30%, −40%, −50%, −60%, −70%, −80%).

- Y axis: gain required to get back to zero (+11%, +25%, +43%, +67%, +100%, +150%, +233%, +400%).

What this shows:

- A −10% drop needs +11% to recover.

- A −50% drop needs +100% to get back to the starting point.

- A −80% drop needs +400% just to break even.

In other words:

The bigger the drawdown, the heavier the climb you need.

This matters especially for:

- Altcoins that can drop 70–90% and never come back.

- Late entries in bull markets, where you buy near the top.

This chart exists to remind you:

- You don’t want to live permanently in “recovering losses” mode.

- It’s better to avoid extreme drawdowns than to force the future to heal the present.

5. Single-asset risk vs portfolio risk 🧺

It’s not just “how much you have in crypto”, it’s how it’s distributed:

Single-asset risk:

- How much you have in BTC, ETH, stablecoins, altcoins.

Portfolio risk:

- If the market drops 60%, how much is that in euros in your real life?

For Rank I, a simple scheme (example, not a hard rule):

- 60–80% in BTC/ETH (core).

- 0–20% in altcoins (optional bets, always small).

- 0–20% in stablecoins (airbag / future ammo).

This helps avoid the classic:

“I’m 90% in one altcoin I saw in a 30-second video.”

6. Position size and impact in euros (not just percentages) 💥

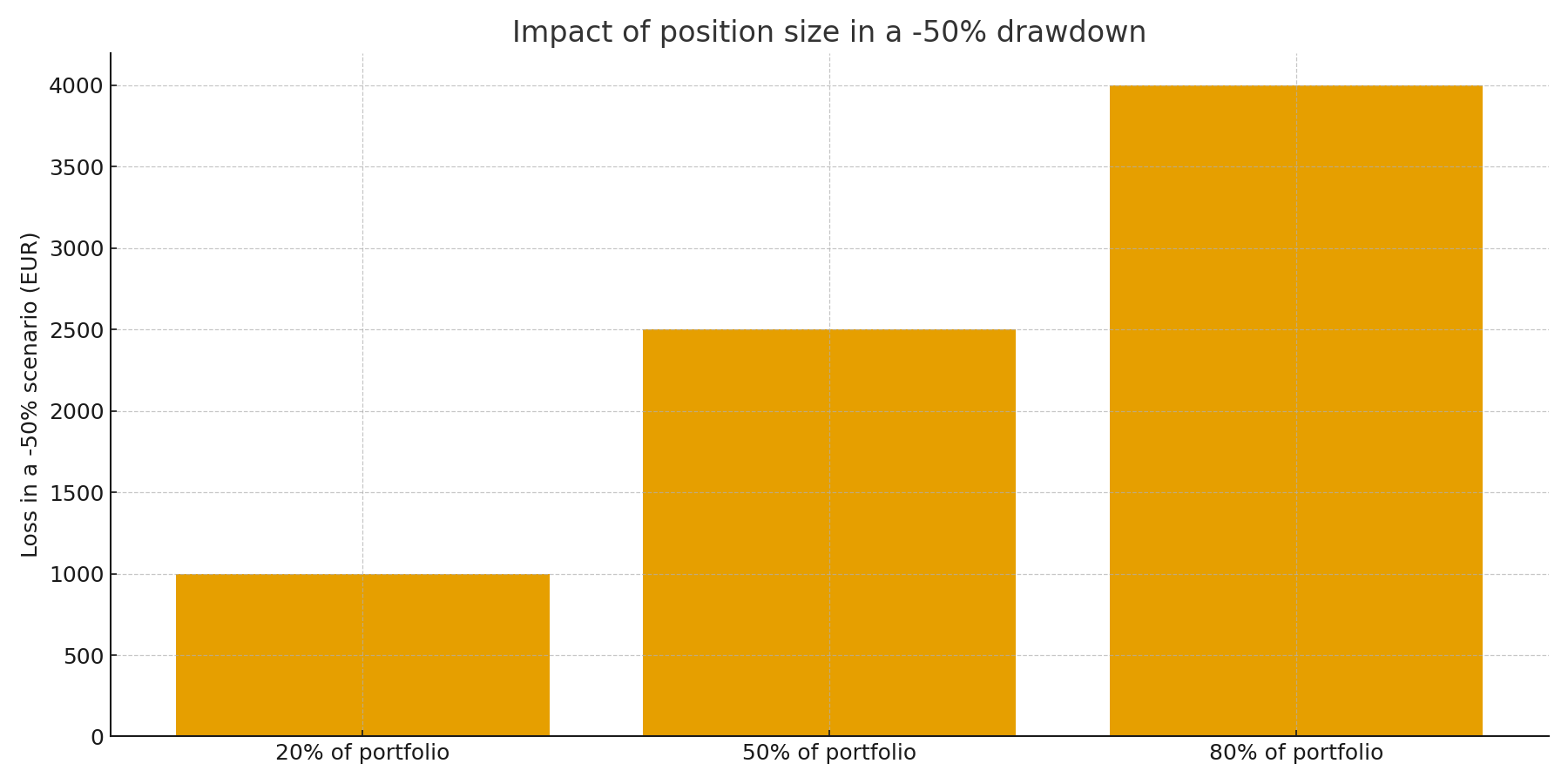

Second chart in the article:

Chart 2 — Impact of position size in a -50% drawdown

risk-position-size-en.png

Setup:

- Assume a portfolio of €10,000.

- Compare 3 scenarios in an asset that drops −50%:

- Position of 20% of the portfolio → €2,000 exposed.

- Position of 50% of the portfolio → €5,000 exposed.

- Position of 80% of the portfolio → €8,000 exposed.

Loss in each scenario:

- 20% position → −€1,000 (−10% of the total portfolio).

- 50% position → −€2,500 (−25% of the total).

- 80% position → −€4,000 (−40% of the total).

The chart shows the gut punch in euros:

- The same −50% drawdown in the asset produces completely different pain just because of position size.

This forces a key question:

“If this drops 50%, will this euro amount ruin my sleep?”

7. Product risk: spot, Earn, DeFi, loans 🧪

Not all risk comes from price. Some comes from the type of product you use:

- Simple spot (BTC/ETH on the spot market):

Price risk (up/down), but easy to understand. - Savings / Earn with stablecoins:

Stablecoin issuer risk + risk of the platform where it’s deposited. - L1 staking:

Protocol risk + asset price risk + possible lock-up periods. - DeFi yield farms / exotic pools:

Smart-contract risk, token risk, liquidity, peg, and often anon teams. - Loans / leverage:

Liquidation risk + interest + snowball effect if the market moves against you.

Sentence to pin on the wall:

“If I don’t understand where the yield comes from, the risk is probably me.” 🔍

8. Behaviour risk: you vs you 🧠

Even with a decent plan, the biggest risk is you:

- Going in heavy after a strong rally (FOMO).

- Dumping everything in a crash because “it’s going to zero” (panic).

- Changing strategies every week, without giving them time to prove anything.

Risk management is also:

- Choosing a position size that doesn’t force you to check the chart 30× a day.

- Defining beforehand:

- How much you’ll invest per month.

- What you’ll do if the market drops 50% (written down, not only in your head).

9. Mini risk management model for hodlers (Rank I) 🧱

Think of this as a “basic preset” you can adjust later:

Total exposure:

- Define a range for crypto, e.g. 5–10% of your total net worth.

Split by asset type:

- Core: 60–80% BTC/ETH

- Altcoins: 0–20% (max 2–3 projects, small positions)

- Stablecoins: 0–20% (airbag / ammo, not a toy).

Fixed monthly contribution:

- An amount you can keep for 6–12 months without stress (linked to the DCA Mission).

Declared emotional limit:

- Write something like:

“If the portfolio drops 50%, I don’t sell everything. I pause, review the plan and my decisions — not the 1-minute chart.”

Simple logging:

- Use the basic Hodler Diary or any sheet:

- Date, asset, amount, price, reason for the buy.

Every 3 months you review: total exposure, weight of each asset and how you felt during drawdowns.

10. Red list: what NOT to do 🚫

Some clear “don’ts” help keep your brain aligned when the market is on fire:

- ❌ Don’t use rent/bills money to buy crypto.

- ❌ Don’t put a big chunk of the portfolio in one “hot” altcoin.

- ❌ Don’t enter loans/leverage without a written plan, an airbag and experience.

- ❌ Don’t double your position just to “recover faster”.

- ❌ Don’t confuse “Twitter storytelling” with risk assessment.

11. Closing: your job is not to predict, it’s to survive 🪖

At the end of the day:

Your job as a hodler is not to nail the exact top or bottom. It’s to survive the cycles without blowing up your account or your head.

In practice, risk management is:

- Reducing the odds of making dumb decisions in extreme moments.

- Organising position size, the drawdowns you accept and the time you can wait.

- Making sure that when the next bull market shows up, you’re still in the game.